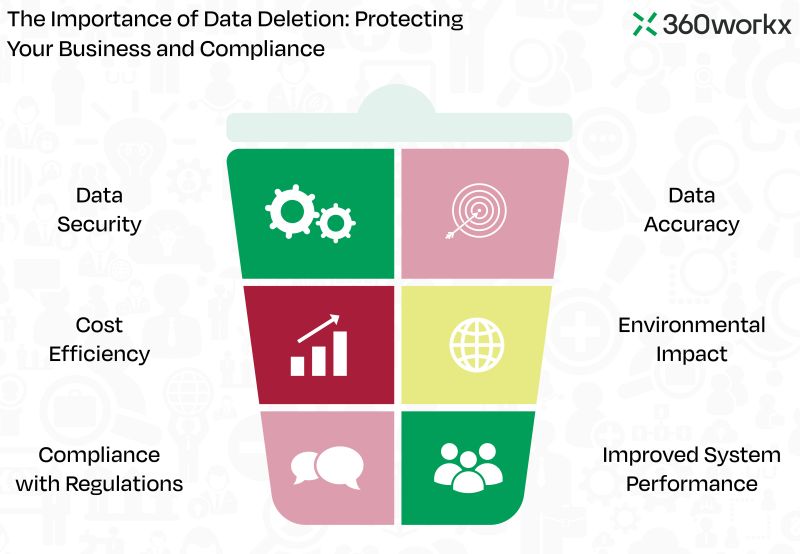

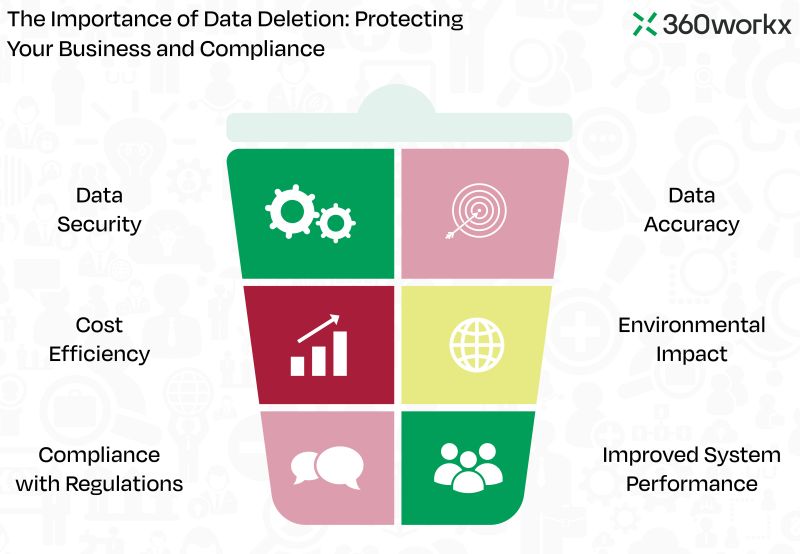

The Importance of Data Deletion: Protecting Your Business and Compliance

In today’s data-driven world, businesses focus heavily on collecting and storing data. However, the deletion of data is just as important as its

Navigating Regulatory Complexity and Data Management Hurdles in Finance

Financial institutions must comply with rigorous regulations like GDPR, CCPA, and industry-specific laws such as PCI DSS and Basel III, requiring secure handling, storage, and deletion of customer data.

Data silos across CRMs, financial management platforms, transaction systems, and legacy databases create inefficiencies and compliance risks.

Outdated applications often lack automated data management capabilities, and Shadow IT introduces unregulated data, complicating compliance.

Storing outdated or redundant data increases vulnerability to breaches, fraud, and cyberattacks, putting sensitive financial information at risk.

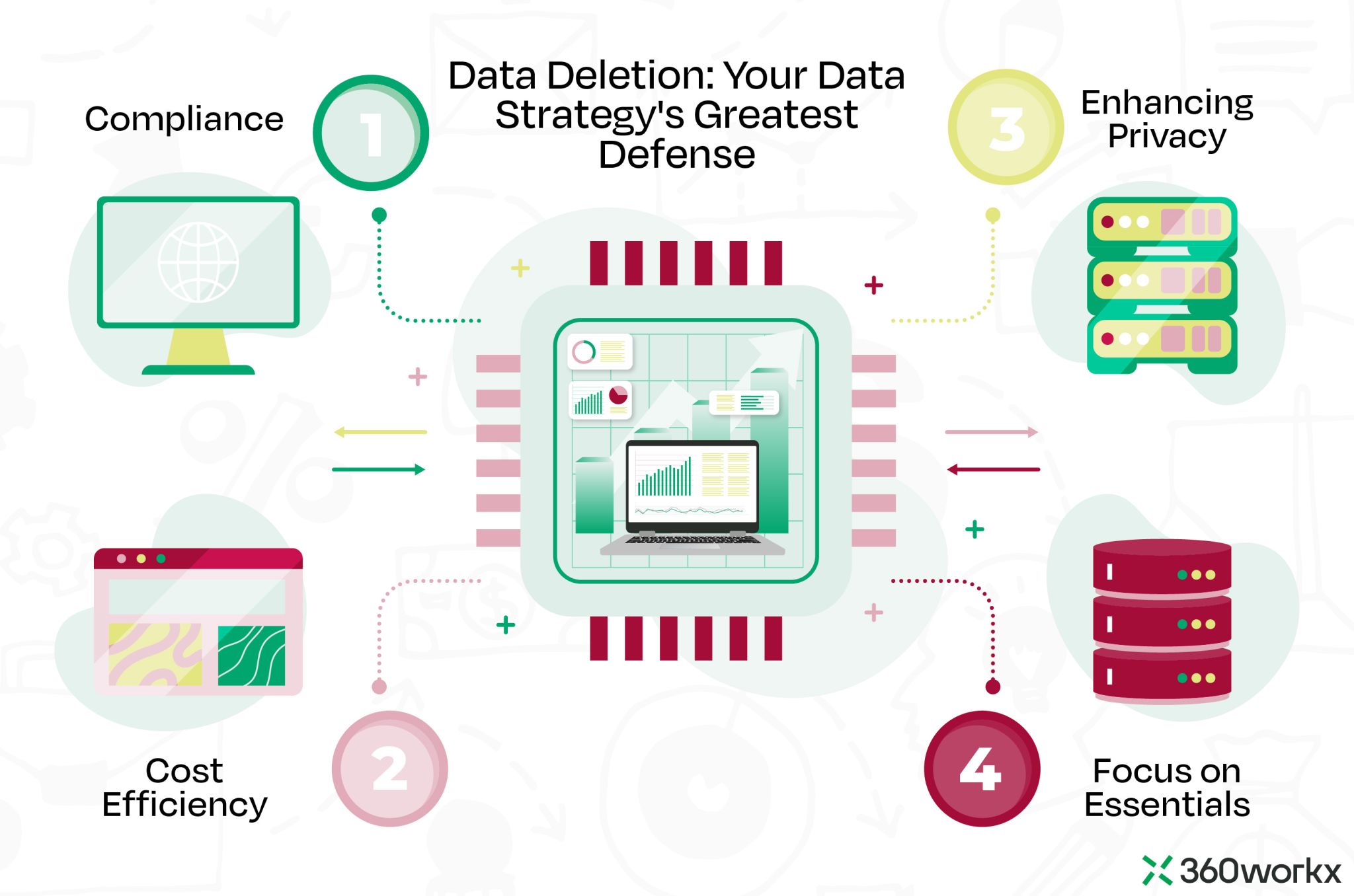

Data Privacy Hub automates data deletion processes to meet global privacy laws and financial regulations, ensuring accountability and compliance.

Consolidate and manage data deletion tasks across all systems, including CRMs, transaction platforms, and financial planning tools, from a single platform.

Automatically delete unnecessary data, reducing the exposure to breaches and minimizing risks associated with outdated information.

Follow a hierarchical approach to deletion, ensuring dependencies between financial records are maintained.

Schedule a demo to see how our platform can revolutionize your approach to data governance.

Personalized walkthrough tailored to your organization's needs.

In today’s data-driven world, businesses focus heavily on collecting and storing data. However, the deletion of data is just as important as its

In today’s data-driven world, protecting sensitive information is a top priority. While security measures like encryption and access controls are essential, one often

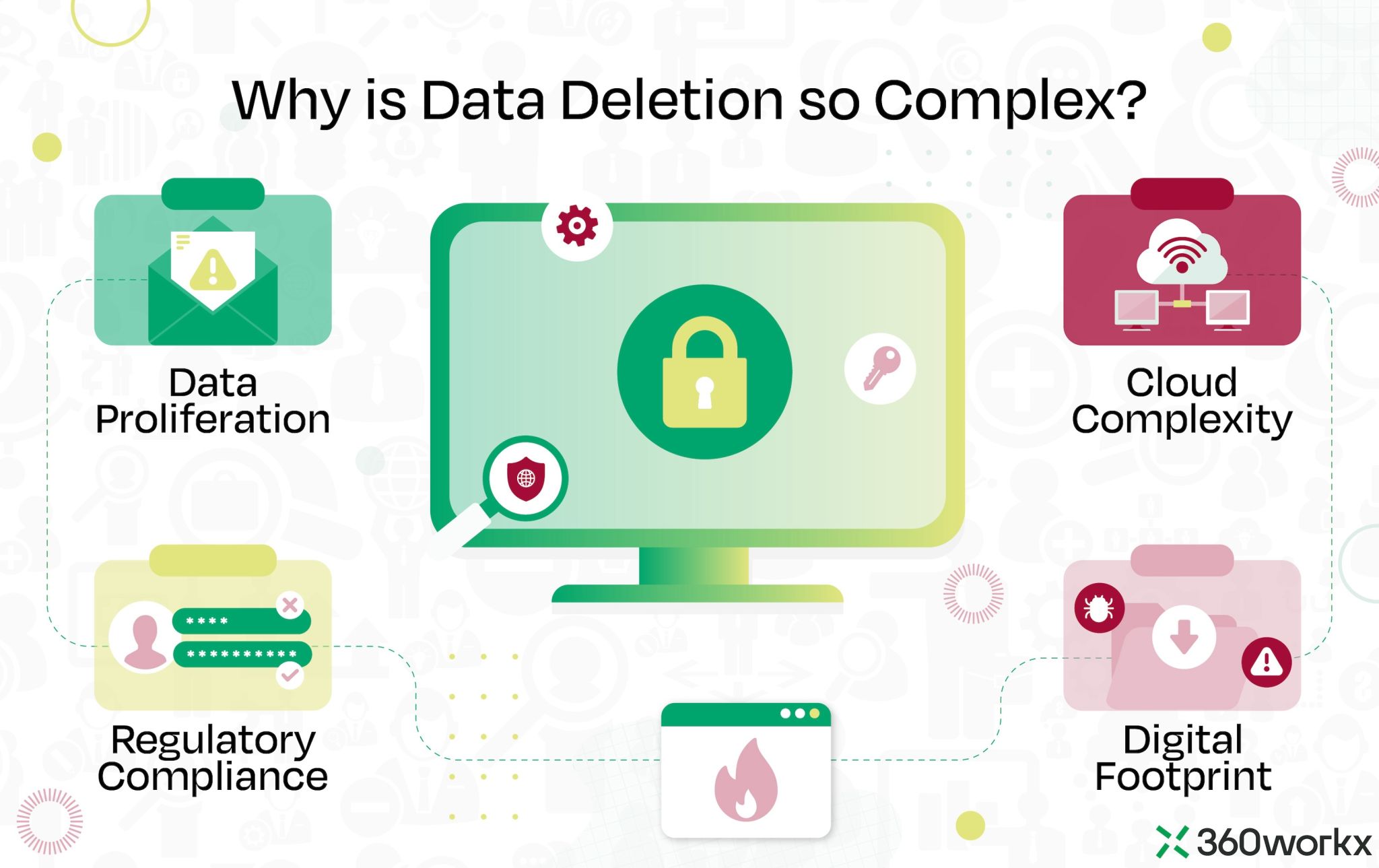

In an era dominated by data, organizations and individuals alike face an overwhelming challenge—managing and securely deleting data. While storing and processing data

Be the first to know about updates, features, and industry insights.

Empowering seamless data privacy management worldwide.Empowering seamless data privacy management worldwide.

© 2024 Data Privacy Hub | All rights reserved. Web Application by Cyberhub Technologies